What is SAP TRM?

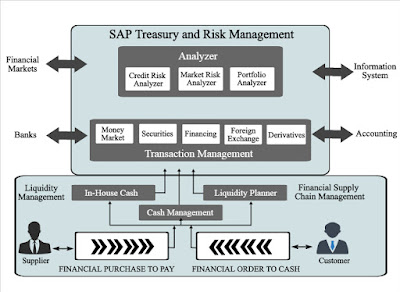

SAP TRM - Treasury and

Risk Management is a set of solutions which are equipped towards examining and

optimizing business processes within the economics area of an organization. SAP

Treasury is a modern SAP application that succeeds in giving companies with the

many required aggressive side by securing sufficient management and power of

treasury processes; is utilized for interpreting tasks and establishing the

Financial Supply Chain Management system. This module presents tools for cash

and liquidity management, accurate forecasts, efficient use of cash, audit

controls, and an overall decrease in operational risks. Control business risks

more efficiently with comprehensive SAP treasury and risk management solutions.

|

| SAP Treasury and Risk Management |

The Basic Functional area of Treasury and Risk Management includes:

- Market Data Management

Utilizing the Market Data Transfer from Spread sheet role, you can import up to 1000 degrees and rates from a spread sheet to the SAP System.The ideas are given by real-time data feed enable you to work with market data efficiently. You require an outside interface program provided by your data supplies provider that passes the market data to the SAP System in a proper form.

- Central master data management

In the Master Data sector under Basic Roles, you can choose the details for Banks and House Banks. The master data for banks is saved midway in the SAP System in a bank directory. You can obtain this data from the application, for example, if you desire to register bank details for a business partner.

- Roles of Users in Treasury and Risk Management

- Dealer

- Administrator

- Limit Manager

- Back Office Processor

- Risk Controller

- Fund Manager

- Staff Accountant

- Treasury Manager

- Trade Controller

Roles of Users in Treasury and Risk Management

This division comprises

the unique roles for the Treasury and Risk Management (TRM) element:

Dealer

The dealer manages the

report in Cash Management and Market Risk Management keeps the direct connection

with the business partners, negotiates and accomplishes transactions or orders,

exercises options and other rights, and registers transactions and positions.

Administrator

The administrator is

competent for basic supervisory tasks in the Treasury area. This person maintains

the system up-to-date.

Limit

Manager

The Limit Manager is

accountable for performing the required limits to reduce the counterparty/issuer

failure risk

Back

Office Processor

The back office

processor verifies and validates transaction actions taken out by the trader.

Risk

Controller

The risk controller

measures and examines the company's risks and possibilities on the basis of

market data, with the intention of developing risk-oriented strategies and

evaluating the outcomes of certain decisions.

Fund

Manager

The fund manager is

responsible for presenting data about the short- and medium-term financial

position as a basis for financial planning.

Staff

Accountant

The staff accountant

records on the activities that have been prepared by the back office staff and

takes out the required postings, accruals/deferrals, and estimates.

Treasury

Manager

The Treasury Manager is

accountable for maintaining all the company's treasury actions. Applying

evaluation reports, this person guarantees that the different policies

established for trading, market risk management, cash management, and limit

management have been followed.

Trade

Controller

The trade controller

tries to evaluate achievements, recognize promising strategies and monitor their

effects.

Sub

Modules of SAP Treasury and Risk Management:

- CM - Cash Management

- CFM - Corporate Finance Management

- Risk Management

Some

Important tasks covered in SAP Treasury applications are:

• SAP Treasury and Risk Management

• SAP Bank Communication Management.

• SAP Cash and Liquidity Management

• SAP In-House Cash Management

SAP Treasury and Risk Management online training course intended at making you a specialist in a set of solutions that are executed for analyzing and optimizing business processes in the finance role of a business.Suggested for SAP consultants, cash managers, project managers, accountants, and team members managing cash flow/ risk management, this course improves the range of job opportunities in various functional modules. Visit us for SAP Treasury courses in UK and SAP Treasury courses in India. Apart from SAP TRM Online Training, SAPVITS Offers training for:

Website: http://www.sapvits.com/

ABOUT SAPVITS

SAPVITS is acknowledged as one of the best SAPOnline training institutes to present excellent SAP education. SAPVITS has branches in India (Pune, Mumbai, Hyderabad, Bangalore, Chennai, Gurgaon, Noida, and Delhi), UK (London), and USA (New York), Singapore, Australia, Canada etc.SAP Treasury and Risk Management online training course intended at making you a specialist in a set of solutions that are executed for analyzing and optimizing business processes in the finance role of a business.Suggested for SAP consultants, cash managers, project managers, accountants, and team members managing cash flow/ risk management, this course improves the range of job opportunities in various functional modules. Visit us for SAP Treasury courses in UK and SAP Treasury courses in India. Apart from SAP TRM Online Training, SAPVITS Offers training for:

- SAP FICO Training inPune

- SAP Simple FinanceTraining in Hyderabad

- SAP Simple LogisticsTraining in Bangalore

- SAP C4C Training inBangalore

- SAP ABAP Training inMumbai

- SAP SRM Training in Pune

- SAP Basis Training in Delhi

- SAP TM Training in Hyderabad

- SAP CS Training in Bangalore

- SAP SD Training in Chennai

Attend free online demo

for any of these courses by registering at- https://goo.gl/HYV5qK

Contact us:

Website: http://www.sapvits.com/

Email ID: info@sapvits.com

IND: +91 880 532 2100

USA: +1 912 342 2100

UK: +44 141 416 8898

Comments

Post a Comment